Union Pacific Railroad Mineral’s Portfolio

I have had the great pleasure of working in Railroad Real Estate for the past 12 years.(1) There are many niche areas in Railroad Real Estate, and one of the most interesting is Union Pacific Railroad’s (UP) Mineral Rights portfolio.

The majority of the UP portfolio is comprised of oil and gas interests, but also includes water and other various subsurface resources, including but not limited to gravel, lithium, cobalt, natural gas storage, carbon capture, and geothermal resources across 23 states. But before we get into the nuts and bolts of UP’s Mineral Rights, it’s critical to understand UP’s predecessor history as UP holds the Mineral Rights from hundreds of predecessor Companies.

UP was chartered by Congress in 1862 to build the first transcontinental Railroad westward from Omaha, Nebraska. UP is still headquartered in Omaha today. The construction of the transcontinental Railroad began in earnest in 1865 and was completed May 10, 1869, with the driving of the ceremonial golden spike at Promontory Summit, Utah.

Over the next century, UP absorbed many other Roads. UP absorbed the Missouri Pacific, the Western Pacific and the MKT (Missouri Kansas Texas) in the 1980s, and the Chicago Rock Island in part, and Chicago North Western in 1995, completing UP’s reach into the upper Midwest. In 1996, UP merged with the Southern Pacific Transportation Company (SP), which was itself, before the UP merger, a significant rail system that was absorbed by the Denver and Rio Grande Western Railroad. Throughout all these mergers and acquisitions, UP retained a significant portfolio of Mineral Rights held by its predecessors. There are some complicated exceptions, such as Project Spike,(2) to which justice cannot be done without a separate article.

UP has a substantial Mineral Rights portfolio. As stated previously, the majority of the UP portfolio is comprised of oi and gas rights. One interesting example of this is that UP (and predecessor SP) held oil and gas interests in Southern California, more specifically, Huntington Beach in the 1920s.

Today, Huntington Beach, California shown in the above photo in 1926, is a sleepy beach town, where surfing is believed to have been first introduced to California from Hawaii in 1925.

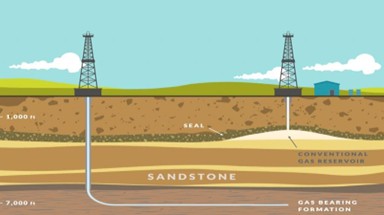

This photo from 1926 demonstrates traditional vertical drilling, which still is in regular use today across the country. Many of the UP’s modern oil and gas leases cover hydrocarbons obtained from horizontal drilling, which is also demonstrated in the image below.

Today, the most active oil and gas plays are the Permian Basin in West Texas and southeastern New Mexico, the Eagle Ford located in south Texas and the DJ Basin in Northeast Colorado. UP holds Mineral Rights interests in the Permian, Eagle Ford and DJ Basin in addition to other active producing areas.

The UP Minerals Team is comprised of UP employees working on new mineral rights leases across the UP system, and who manage our UP consultant landmen and attorneys, who are working the most current active oil and gas plays located on or near property either owned by UP or where UP retains the mineral rights. The UP Minerals Team is also supported by outside mineral management companies who help UP manage the often very complicated accounting, auditing and financial management system necessary to manage UP’s Mineral Royalty payments and their related well production information across 23 states.

The UP Minerals team wears many hats. There is never a dull moment as every State UP operates in, and in which UP holds mineral rights, across the country has very different statutory procedures for dealing with Mineral Owner’s interests. Most States’ statutory frameworks are very protective of the large Oil and Gas Producers who are involved in the exploration, extraction, refining, transportation, and marketing of oil and natural gas. UP as a transportation leader is very involved in the Oil and Gas industry on the freight rail side of the business. UP’s secondary interest in the Oil and Gas industry is as a Mineral Rights Owner.

The day-to-day work of the UP Minerals Team regards the negotiation and execution of leases with lease bonuses for new oil and gas plays. UP then enjoys the royalty revenue streams on the back end of these leases. Generally speaking, oil and gas royalties are paid based on the production of hydrocarbons that have already been produced and sold. UP is not involved in the production or sale process which makes billing impossible. Because of the vast number of leases and producing wells on UP property across the UP network, the UP team may receive hundreds of separate royalty checks per month. Hence, the necessity for outside IT companies.

In order to properly manage the UP portfolio, it also necessary to review royalty payments for the accuracy of the reported production volumes, prices, deduction values, and income to make sure UP is properly compensated for its Mineral Rights portfolio. This is where our awesome UP Mineral’s team, including our consultants, step in and make the day-day work of the UP Minerals team happen.

The UP Minerals Team has fun as well. We (3)attend the largest annual oil and gas conference in the country in Houston, Texas. NAPE provides the rare opportunity for UP Real Estate to conduct business face to face with many of our Mineral Royalty Lessees. We are able to meet with new Lessees, and third-party consultants, and were able to negotiate some particular lease terms, and manage some other pressing business issues. The oil business is still a handshake business, and being able to physically shake a hand in person goes a long way. To make the point, the marketing slogan for NAPE is “Where Deals Happen.”

UP is very proud of its tradition as the oldest Class 1 Railroad and the second oldest publicly traded company on the Stock Exchange, and the UP Real Estate-Minerals Team is very proud to help carry on this tradition by continuing to manage and grow UP’s vast Mineral Rights portfolio. Please direct any questions about this article to David LaPlante at [email protected].

References

- The author is David LaPlante – Director, Union Pacific – Real Estate.

- Project Spike generally regards the spinoff of Union Pacific Resources from parent company UP Corp. Note: As part of the transaction, UP Resources only received certain mineral interests.

- The UP Minerals Team fearless leader, General Director Dan Leis, is not pictured as he is working the floor at NAPE! Pictured left to right: Matt Kozisek (Mgr-UP Real Estate), David LaPlante (Dir-UP Real Estate), and Jonathan Holland (Mgr-UP Real Estate).